QUICK. Adaptable. Secure.

QUICK. Adaptable. Innovative.

FundGate recognizes the importance of capital for your business growth, minus the complexities of traditional banks. We provide a tailored solution to swiftly deliver the capital you require precisely when it’s most crucial.

FundGate offers alternative funding to companies in need of rapid cash flow. We have both short- and long-term plans, and we can fund your request in as little as 2 or 3 days.

Prerequisites

Secure Approval

Access Your Funds

FundGate offers inventive financing options to small business proprietors as an alternative means of obtaining funds. FundGate offers unconventional financial solutions for businesses in search of swift capital access. We provide both short and long-term financing options, ensuring you can secure funding within a timeframe of 24 hours.

Secure Your Business's Stability with the Vital Capital Funding You Require.

Traditional business loans may not always be the ideal solution.

FundGate, we specialize in swiftly and securely providing working capital to businesses seeking opportunities for growth and expansion. Our array of flexible options is designed to leverage future receivables, ensuring your business can thrive.

Financial Support for Small Enterprises

Collaboratively, we devise a growth strategy tailored to your business. You receive an upfront payment, and in return, we receive a portion of your future sales until a predetermined amount is reached.

Merchant Cash Advance (MCA)

Obtain an advance based on your future purchase sales. We retrieve a percentage through ACH debits from your business checking account or credit card processing transactions.

Capital Funding for Operational Needs

A straightforward method to support your day-to-day business operations. Secure the necessary funds to maintain the smooth operation of your business, distinct from significant expenditures.

Invoice Financing

We provide cash advances by acquiring outstanding invoices, offering a swift and efficient solution to address delayed customer payments or cash flow disruptions.

Drawing upon decades of expertise in small business solutions, our team of professionals will craft a dynamic strategy aimed at optimizing your growth potential.

WHY CHOOSE FUNDGATE?

We offer the essential capital to fuel your success. Our financing solutions are designed to capitalize on growth prospects, including inventory procurement, marketing initiatives, equipment upgrades, staffing expansion, and more. Rest assured, you won’t incur any broker fees, as we are a direct funding source.

FINANCING FOR ALL BUSINESS TYPES

Numerous traditional banks decline applications from a multitude of businesses. Our customer base comprises entrepreneurs seeking swift and uncomplicated funding solutions to fulfill their financial needs. We collaborate with a diverse range of enterprises across various industries, providing funding programs characterized by adaptable payment options and flexible duration terms.

Intelligent Business Insight

With decades of experience, our team specializes in assisting small businesses that may have encountered rejection or reluctance from traditional financing avenues. As your partner, we invest the effort to comprehend and address the unique requirements of your business, steering it toward a successful path forward.

FundGate collaborates with businesses similar to yours on a daily basis. We offer tailored programs for a wide range of business types, featuring adaptable payment options and duration terms. Here are some examples of the diverse businesses we assist:

- Advertising Agencies

- Design Studios

- Marketing Firms

- Printing & Publishing

- Public Relations Firms

- Web Consultants

- Air Transport

- Auto Dealers

- Automotive Repair

- Car Rental

- Moving Companies

- Sea Transport

- Taxi & Limo Services

- Trucking

- Food Processing & Sales

- Food Products Manufacturing

- Nutritional & Dietary Supplements

- Organic Food & Beverage

- Specialty / Retail Food Stores

- Motion Picture Production & Distribution

- Video, Film & TV Production

- Music Production

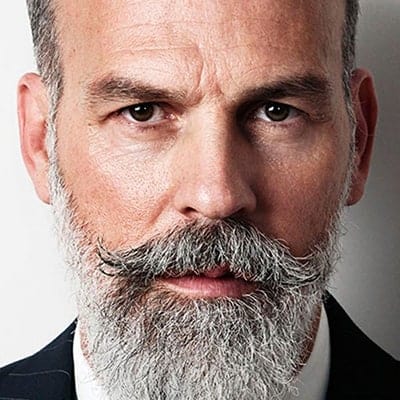

Fast, dependable, and highly responsive, FundGate assisted me in launching two new locations within a matter of days.

Fast, dependable, and highly responsive, FundGate assisted me in launching two new locations within a matter of days.

FundGate is exceptional; I've had an established business for years, and this service practically markets itself.

The procedure was straightforward, and every person involved was highly informed and displayed professionalism.

Application Today

FundGate collaborates with businesses similar to yours on a daily basis. We offer tailored programs for a wide range of business types, featuring adaptable payment options and duration terms. Here are some examples of the diverse businesses we assist: